Capital Asset Pricing Model

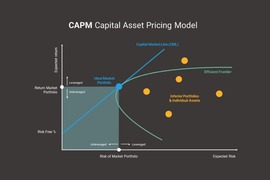

The Capital Asset Pricing Model (CAPM) is a cornerstone of modern finance that explains the relationship between risk and expected return in investing. Developed in the 1960s by economists William Sharpe, John Lintner, and Jan Mossin, CAPM provides a formula to estimate the expected return of an asset based on its systematic risk (beta) and the risk-free rate of return. Built on the foundations of modern portfolio theory, the model highlights the trade-off between risk, return, and diversification, suggesting that higher returns are only possible by taking on greater risk. Today, CAPM remains widely used as a benchmark for investment performance, a tool for calculating the cost of equity capital, and a guide for asset allocation and portfolio management decisions.

CAPM FORMULA

ERi = Rf + βi(ERm − Rf)

Where:

ERi = expected return of investment

Rf = risk-free rate

βi = beta of the investment

(ERm − Rf) = market risk premium

COMPONENTS OF CAPM

Risk-Free Rate

The risk-free rate is the baseline return an investor can earn from an investment with no risk, typically represented by government bonds. It sets the minimum return investors expect before taking on additional risk.

Beta (Systematic Risk)

Beta measures an asset’s exposure to systematic risk—the portion of risk that cannot be eliminated through diversification. It reflects how volatile an asset is compared to the overall market.

The market risk premium represents the additional return investors demand for taking on the risk of investing in the market portfolio (all risky assets) above the risk-free rate. It compensates investors for bearing systematic risk.

ASSUMPTIONS & LIMITATIONS OF CAPM

Efficient Markets

CAPM assumes markets are perfectly efficient and that all available information is instantly reflected in asset prices. In practice, markets can be inefficient due to mispricing, speculation, or information asymmetry.

Investor Rationality

The model assumes investors are rational, risk-averse, and base decisions solely on risk and return. In reality, behavioral biases and emotions often influence investment decisions.

Single-Period Model

CAPM is designed as a single-period model, which does not account for changes in risk, interest rates, or returns over multiple time horizons.

Single-Factor Dependence

CAPM relies only on beta to measure risk. However, multi-factor models such as the Fama-French three-factor model can provide more granular insights by including size, value, and other factors.

Measurement Challenges

Inputs like the risk-free rate, beta, and the market risk premium are difficult to measure precisely and are subject to estimation errors or market fluctuations.

Diversification Assumption

The model assumes investors can hold fully diversified portfolios, which may not be realistic for smaller or individual investors with limited resources.