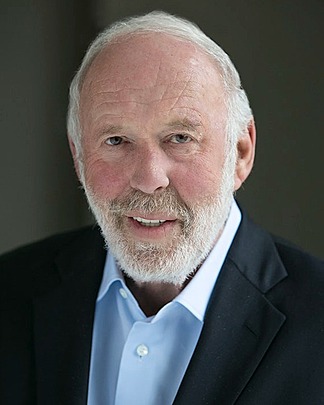

Jim Simons

Jim Simons was an award-winning mathematician and legendary quant, popularly known as the "Quant King" and "Warren Buffett of algorithms". Simons was the Founder of Renaissance Technologies, one of the most prominent and profitable hedge funds. His flagship Medallion Fund has had an annual return of 40% since its inception and is one of the most successful and widely recognized hedge funds in history. Simons pioneered mathematical models and algorithms to make investment decisions and left behind a track record at Renaissance Technologies that rivaled that of legends such as Warren Buffett and George Soros. He had also taught mathematics at MIT, Harvard University, and Stony Brook University. Simons passed away in May 2024 at the age of 86.

Jim Simons Professional Experience / Academic History

Professional Experience

-

Founder

-

Founder, Chairman, and Chief Executive Officer

Academic History

-

Ph.D., Mathematics

-

B.S., Mathematics

The Medallion Fund has acquired legendary status in the financial world and is undoubtedly the crown jewel of Renaissance Technologies.

Under Simon's leadership, the fund consistently delivered high returns, significantly outperforming the S&P 500.

The fund has annual returns often cited between 30% to 50% after fees, famed for the best record in investing history.

The fund is known for its secrecy and is closed to outside investors, accessible only to RenTecs' employees, past employees, and their families.

THE QUANT KING

Simons had been deemed the "Quant King" for relying entirely on quantitative analysis and algorithmic investment strategies.

He quantitative models based on statistical and mathematical analyses to uncover market inefficiencies.

His algorithmic trading approach leverages vast amounts of data to predict price movements, setting it apart in the investment world.

EARLY LIFE & CAREER

During the Vietnam War, he worked as a codebreaker for U.S. intelligence, monitoring the Soviet Union and successfully cracking a Russian code.

He shifted course from teaching mathematics and working in U.S. intelligence to investing.

His pioneering use of computer signals for trading decisions earned him the nickname "Quant King."

ACADEMIA

The quant guru previously chaired the maths department at Stony Brook University in New York.

His mathematical breakthroughs are instrumental to fields such as string theory, topology and condensed matter physics.

His research in differential geometry earned him widespread recognition and respect in the mathematical community.

PHILANTHROPY