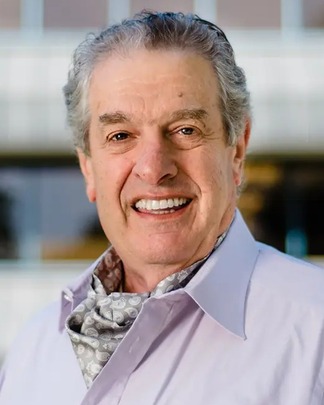

Charles Biderman

Charles Biderman is a seasoned entrepreneur, investor, and market analyst, best known as the Founder and CEO of TrimTabs Asset Management and TrimTabs Investment Research, a leading independent research firm specializing in analyzing the supply and demand of equities and investment capital flows. With decades of experience, Biderman has become a prominent voice in market liquidity, behavioral finance, and data-driven investment strategies. He is also the author of TrimTabs Investing, where he outlines his evidence-based investment philosophy. Before founding TrimTabs, Biderman built a successful career in real estate, which shaped his analytical approach to understanding market cycles, capital movement, and investor behavior. His insights are frequently sought by major financial media outlets, solidifying his reputation as a trusted authority on market dynamics.

Charles Biderman Professional Experience / Academic History

Professional Experience

-

Founder and CEO

-

Assistant

Academic History

-

Master of Business Administration

-

B.A., History and Political Science

TrimTabs Asset Management and TrimTabs Investment Research are widely recognized as the only independent research firms delivering detailed daily coverage of U.S. stock market liquidity.

Under Charles Biderman’s leadership, TrimTabs became an indispensable resource for some of the world’s largest asset managers, with clients including nearly one-third of the globe’s top money management firms.

In 2011, TrimTabs launched its first exchange-traded fund (ETF) — the TrimTabs Float Shrink ETF (TTFS) — applying the firm’s proprietary liquidity models to create innovative investment products.

Today, TrimTabs’ daily liquidity analyses continue to provide critical insights into equity market flows, empowering institutional investors, hedge funds, and active traders to make data-driven decisions.

EARLY CAREER

Biderman began his career as Alan Abelson’s assistant at Barron’s, where he notably predicted the collapse of real estate investment trusts.

After a brief stint as a short seller on Wall Street, he shifted to real estate entrepreneurship, orchestrating deals in Tennessee and New Jersey.

He went on to manage a diverse property portfolio, including 1,000 apartments in Nashville and multiple office buildings in Dallas and Memphis — experiences that laid the groundwork for his market liquidity expertise.

MEDIA PRESENCE

Biderman has appeared on financial television over 200 times, earning a reputation as a trusted commentator on market liquidity and supply-demand dynamics.

He is a regular guest on CNBC and Bloomberg, frequently sharing insights on how liquidity trends shape market behavior.

His expertise has also been featured in leading financial publications including Barron’s, The Wall Street Journal, Forbes, Yahoo! Finance, and Investor’s Business Daily.