Fixed Income

Fixed income broadly refers to those types of investment security that pay investors fixed interest or dividend payments until their maturity date. Fixed income investments, or bonds as they are commonly known, typically provide a premium above inflation and experience less return volatility compared with shares. These investments are designed to generate a specific level of interest income, while also providing diversification, capital preservation, and potential tax exemptions. While stocks get headlines, fixed income is a more low-key source of cash flow and capital preservation. Often, when stocks are declining in value, fixed income is gaining in value, making them an important hedge. Other common asset classes include equities (e.g., stocks), cash and equivalents, real estate, commodities, and currencies.

Experts - People

Aaron Brown

Aaron Hodari

Aaron Kaplan

Aaron Uitenbroek

Adam Cohen

Adam O'Dell

Adrian Helfert

Alan Greenspan

Alan Gula

Alan Higgins

Albert Yeh

Alberto Gallo

Alex Bryan

Alex Gurevich

Alex Hoeptner

Alex Lennard

Alex Lieberman

Alfonso Peccatiello

Ali Hassan

Allison Schrager

Amanda Agati

Amanda Tepper

Amelia Bourdeau

Amlan Roy

Amy Hong

Amy Oldenburg

Amy Raskin

Andreas Clenow

Andreas Steno Larsen

Andrew Feldstein

Andrew Park

Andrew Saunders

Andrew Schneider

Andrew Schultz

Andy Edstrom

Andy Hecht

Angelo Manioudakis

Angelo Robles

Angus Shillington

Aniket Ullal

Anil Lulla

Anne Richards

Anneka Treon

Anthony Scaramucci

Anton LeRoy

Ari Paul

Arik Ben Dor

Art Hogan

Arthur Hyde

Aryeh Bourkoff

Asoka Woehrmann

Austin Campbell

Austin Root

Barney Mannerings

Barry Knapp

Bart Melek

Ben Breitholtz

Ben Chrnelich

Ben Hunt

Ben Melkman

Ben Powell

Ben Tisch

Benjamin Halliburton

Benoit Bosc

Beth Hammack

Bilal Hafeez

Bill Blain

Bill Campbell

Bill Demchak

Bill Gross

Bill Gurtin

Bill Kaye

Bill Poulos

Bo Zhang

Bob Elliott

Bob Johnson

Bob Kunimura

Bob Lang

Bob Treue

Bobby Jain

Brad Levy

Bradley Duke

Brendan Ahern

Brent Donnelly

Brett Caughran

Brett Tejpaul

Brian Kelly

Brian Levitt

Brian McCarthy

Brian Nelson

Brian Portnoy

Brian Shannon

Brian Weinstein

Brian Werdesheim

Brooker Belcourt

Bruce Mumford

Bruce Munster

Bruce Phelps

Bruce Richards

Bruno Pannetier

Bryan Campbell

Callum Thomas

Cameron Hight

Carley Garner

Carter Malloy

Cathie Wood

Cem Karsan

Chad Morganlander

Chaim Siegel

Charles Biderman

Charles Sizemore

Charles Tall

Charlie McGarraugh

Charlie Morris

Chen Zhao

Chiente Hsu

Chris Aitken

Chris Alexander

Chris Bailey

Chris Berry

Chris Blasi

Chris Castroviejo

Chris Cole

Chris DeMuth Jr

Chris Eddy

Chris Hohlstein

Chris Joye

Chris Olsen

Chris Pavese

Chris Perkins

Chris Vermeulen

Chris Whalen

Christophe Ollari

Clark Fenton

Cormac Kinney

Corvin Codirla

Courtney Smith

Crista Huff

Dan Barclay

Dan Greenhaus

Dan Jerrett

Dan Morehead

Dan Passarelli

Dan Rasmussen

Dan Zwirn

Dana Stewardson

Daniel Lacalle

Daniel Strachman

Danielle Booth

Darius Dale

Dave Breazzano

Dave Descalzi

Dave Donnelly

Dave Mazza

David Berns

David Dorr

David Dredge

David Duong

David Hunt

David Keller

David Kotok

David Magrone

David Merkel

David Modiano

David Nage

David Namdar

David Packham

David Shimko

David Tepper

David Trainer

David Woo

David Zervos

Davis Edwards

Dean Curnutt

Dean Trindle

Debashish Bose

Diana Choyleva

Diana Joseph

Diego Parrilla

Divya Narendra

Dominique Dwor-Frécaut

Don d'Adesky

Donald van Deventer

Doug Kinsey

Doug MacKay

Douglas Borthwick

Douglas Lucas

Drew Zager

Drew Bradford

Drianne Benner

Dwight Emanuelson

Dylan Grice

Ed Dowd

Ed Yardeni

Edward McQuarrie

Edwin Elton

Ehren Stanhope

Eiad Asbahi

Eileen Murray

Elaine Meyers

Eli Rauch

Elliott Allswang

Emad Mostaque

Emma Giamartino

Eric Crittenden

Eric Henderson

Eric Peters

Eric Wallerstein

Euan Sinclair

Evan Lorenz

Fotios Piniros

Francis Hunt

Frank Burke

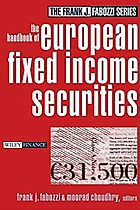

Frank Fabozzi

Frank Holmes

Frank Partnoy

Frank Reilly

Fredrik Nerbrand

Galen Burghardt

Gareth Murphy

Gareth Soloway

Garrett Goggin

Gary Antonacci

Gavin von Loeser

Genevieve Roch-Decter

Geo Chen

Geoff Marcus

Geoffrey Webster

George Clark

George Goncalves

George Saravelos

Gerald Jensen

Gina Sanchez

Giuseppe Paleologo

Glen Strauss

Glenn Degenaars

Gontran de Quillacq

Grace Rodriguez

Greg Diamond

Greg Foss

Greg Obenshain

Greg Onken

Greg Reid

Greg Vaughan

Greg Weldon

Guillermo Dumrauf

Guy Cerundolo

Guy Keller

Hans Humes

Hari Krishnan

Harley Bassman

Harry Melandri

Heather Brilliant

Hector Fernandez

Henry Ma

Hildy Richelson

Howard Penney

Howard Wang

Hugo Philion

Ira Walker

JC Parets

JG Savoldi

JM Mognetti

Jack Inglis

Jake Weber

James Butterfill

James Dondero

James Ferguson

James Helliwell

James Lavish

James Medeiros

Jamie Coutts

Jamil Baz

Jan van Eck

Jared Bibler

Jared Dillian

Jason Dworak

Jason Hsu

Jason Moser

Jason Pagoulatos

Jason Raznick

Jawad Mian

Jay Canell

Jay Pelosky

Jay Soloff

Jeannine Vanian

Jeff Dorman

Jeff Fischer

Jeff Gundlach

Jeff Horowitz

Jeff Kilburg

Jeff Kobernick

Jeff Marcus

Jeff Megar

Jeff Miller

Jeff Mills

Jeff Moore

Jeff Park

Jeff Schulze

Jeff Weiss

Jeff Zirlin

Jeffrey Mettel

Jenny Harrington

Jens Nordvig

Jeremy LaKosh

Jeremy Schwartz

Jerry Hwang

Jim Bianco

Jim Grant

Jim Masturzo

Jim Muzzy

Jim Puplava

Joanna Zeng

Joe Cavatoni

Joe Karas

Joe McAlinden

Joel Litman

John Bowman

John Ciampaglia

John Kiple

John Kosar

John Mousseau

John Murphy

John Palmer

John Rutledge

Jon Eilbeck

Jon Mawby

Jonas Thulin

Jonathan Beukelman

Jonathan Krane

Jonathan Treussard

Jordan Kotick

Jordan Waxman

Jordi Visser

Joseph Amato

Josh Gully

Josh Malkin

Josh Rosner

Julian Brigden

Julien Bittel

Juliette Declercq

Juliette Menga

Jurrien Timmer

Justin Saslaw

Jérôme Stern

Kamil Liberadzki

Kara Murphy

Karen Finerman

Karl Dasher

Kathy Jones

Keith Brown

Keith Dicker

Keith Rosenbloom

Kelley Wright

Kenny Polcari

Kent Collier

Keri Findley

Kevin Coldiron

Kimberly Flynn

Kinjal Amin

Kokou Agbo-Bloua

Komal Sri-Kumar

Kori Hale

Kristina Hooper

Lacy Hunt

Laila Kollmorgen

Lance Roberts

Larry McDonald

Larry Raffone

Larry Robbins

Larry Swedroe

Lars Seier Christensen

Lawrence Lewitinn

Lee Robinson

Leland Clemons

Leo Kolivakis

Leo LiVolsi

Leo Mizuhara

Leon Gaudiosi

Lester Brafman

Lev Dynkin

Lex van Dam

Liz Ann Sonders

Liz Young

Lloyd Khaner

Luis Garcia-Feijoo

Luke Ellis

Luuk Strijers

Lyle LaMothe

Lyle Wolberg

Magdalena Polan

Maleeha Bengali

Marc Chandler

Marc Cohen

Marc Gerstein

Marc Mayer

Marcelo Lopez

Marcos Carreira

Marcos Douer

Margret Trilli

Maria Smirnova

Mario Oliviero

Mark Carney

Mark Cortazzo

Mark Cullen

Mark Douglass

Mark Dow

Mark Sebastian

Mark Shenkman

Mark Versey

Mark Whitmore

Mark Woolley

Marko Kolanovic

Markus Heitkoetter

Martin Gruber

Martin Leibowitz

Martin Leinweber

Martin Pelletier

Marty Fridson

Marvin Barth

Mary Callahan Erdoes

Matt Dillig

Matt Peron

Matt Tucker

Matt Zames

Matteo Perruccio

Matthew Byer

Matthew Graham

Matthew Waz

Matthias Knab

Max Galka

Maziar Minovi

Meb Faber

Michael Ashton

Michael Barrington-Hibbert

Michael Boyd

Michael Covel

Michael Craig-Scheckman

Michael Every

Michael Gayed

Michael Hintze

Michael Howell

Michael Kahn

Michael Kao

Michael Kramer

Michael Lebowitz

Michael Livian

Michael Nicoletos

Michael Petley

Michael Pettis

Michael Pusateri

Michael Rubenstein

Michael Sonnenshein

Michelle Noyes

Mick McLaughlin

Mikael Sarwe

Mike Abrams

Mike Cagney

Mike Cahill

Mike Creadon

Mike Drury

Mike Gallagher

Mike Green

Mike Heroux

Mike Kantrowitz

Mike Reed

Mike Ricca

Mike Robinson

Mike Simcock

Mike Taylor

Mish Schneider

Mish Shedlock

Moe Zulfiqar

Moez Kassam

Mona El Isa

Moss Crosby

Mustafa Chowdhury

Nancy Davis

Neal Berger

Neil Canell

Neil Dutta

Neil George

Neil Schofield

Nelly Nyambi

Nick Hammer

Nick Lawson

Noel Weil

Noreen Beaman

Osman Ozsan

Pablo Calderini

Patrick Boyle

Paul Isaac

Paul Kim

Paul Mampilly

Paul McNamara

Paul Viera

Paul Zemsky

Pei Chen

Pete Briger

Peter Albano

Peter Berezin

Peter Bermont

Peter Boockvar

Peter Brandt

Peter Churchouse

Peter Goodburn

Peter Lacalamita

Peter Seilern

Peter Tchir

Philip Fischer

Philippe Khuong-Huu

Pippa Malmgren

Prateek Mehrotra

Preston McSwain

R. Martin Chavez

Ram Ahluwalia

Ramsey Smith

Raoul Pal

Ray Nolte

Ray Uy

Rayne Steinberg

Rebecca Patterson

Rich Apostolik

Rich Pluta

Rich Saperstein

Richard Bernstein

Richard Brostowicz Jr.

Richard Kim

Richard Lehmann

Richard Sandor

Richard Teng

Richard Zinman

Rick Rieder

Rishi Narang

Rob Davis

Rob Kapito

Rob Shafir

Rob Sharps

Robert Balan

Robert Doty

Robert Grunewald

Robert Levine

Roberto Sallouti

Robin Fink

Ronnie Stoeferle

Roxton McNeal

Rudy Martin

Russ Brownback

Russel Kinnel

Russell Napier

Ryan Ripp

Saagar Gupta

Sabrina Fox

Sahm Adrangi

Said Haidar

Saker Nusseibeh

Sam Burns

Samuel Rines

Sandra Kartt

Sarah Gefter

Sarat Sethi

Scott Siegel

Scott Acheychek

Scott Army

Scott MacKillop

Scott Skyrm

Scott Slayton

Scott Stackman

Scott Wood

Sebastien Page

Serge Berger

Sergio Silva

Sethu Bijumalla

Shannon Saccocia

Shawn Fowler

Shirl Penney

Shundrawn Thomas

Siddhartha Jha

Simon Fine

Simon Ree

Slobodan Jovanovic

Srinivas Thiruvadanthai

Stefan Kreuzkamp

Stephanie Link

Stephanie Ruhle

Stephen Antczak

Stephen Castellano

Stephen Lee

Stephen Miran

Stephen Paras

Stephen Weiss

Steve Hanke

Steve Hollomon

Steve Hou

Steve Kaczmarek

Steve Kurz

Steve Miley

Steven Bavaria

Steven Bleiberg

Steven Goldstein

Steven Hawkins

Steven McClurg

Steven Schoenfeld

Sudhu Arumugam

Sven Miserey

Sylvain Raynes

Tad Rivelle

Taimur Baig

Tariq Dennison

Ted Seides

Terrence Belton

Terri Jacobsen

Thejas Nalval

Theodore Barnhill

Thomas Braziel

Thomas Riegert

Tim Maloney

Tim Seymour

Todd Battaglia

Todd Edgar

Todd Harrison

Todd Silaika

Tom Caddick

Tom Farley

Tom Frame

Tom Gahan

Tom Lee

Tom Moran

Tom Trowbridge

Tommy McBride

Tony Crescenzi

Tony Greer

Tony Mackenzie

Tony Pasquariello

Tony Saliba

Tony Zhang

Tracy Maitland

Trevor Mottl

Tristan Lewis

Troy Thornton

Vicki Bryan

Victor Livingstone

Viktor Shvets

Vince DiLullo

Vince Sarullo

Vincent Catalano

Vincent Randazzo

Vineer Bhansali

Vishal Reddy

Vitaliy Katsenelson

Warren Pies

Will Braman

Will Rhind

Woody Bradford

Woody Brock

Xavier Rolet

Yan Liberman

Yannik Zufferey

Zach Scheidt

Zed Francis

KEY NOTES

Government and corporate bonds are the most common types of fixed-income products.

For most investors, stocks and bonds go together like peanut butter and jelly. They’re the two main pillars of a well-balanced portfolio, the key ingredients in your long-term wealth.

Many people shift their portfolios toward a fixed-income approach as they near retirement, since they may need to rely on their investments for regular income.

TYPES OF FIXED INCOME PRODUCTS

Treasury Bills (T-bills). Short-term fixed-income securities that mature within one year that do not pay coupon returns. Investors buy the bill at a price less than its face value and investors earn that difference at maturity.

Treasury Notes (T-notes). Come in maturities between two and 10 years, pay a fixed interest rate, and are sold in multiples of $100. At the end of maturity, investors are repaid the principal but earn semiannual interest payments until maturity.

Treasury Bonds (T-bonds). Similar to the T-note except that it matures in 20 or 30 years. Treasury bonds can be purchased in multiples of $100.

Treasury inflation-protected securities (TIPS). Protect investors from inflation. The principal amount of a TIPS bond adjusts with inflation and deflation.

Municipal Bonds. Commonly called munis, state governments, municipalities or other governmental agencies issue this form of fixed income. Muni bonds can have tax-free benefits to investors as well.

Corporate Bonds. Corporations sell these types of fixed income securities. The yield typically depends in part on the creditworthiness of the issuer. The higher the credit rating, the lower the coupon rate.

High yield Bonds. Also known as junk bonds, these securities are typically issued with higher coupon rates than investment-grade bonds due to lower credit ratings and greater risks of default.

Certificate of Deposit (CD). A fixed income vehicle offered by financial institutions with maturities of less than five years.

FIXED INCOME ADVANTAGES

Diversification. Investors never want to have their eggs in one basket. It is true that stocks tend to beat bonds over the long haul, but you’re better off moderating your risk, especially in the near term.

Income Generation. Due to the fixed coupon payments that investors receive at specified intervals, bonds can provide a steady and predictable flow of income.

Corporate Preservation. Bonds make sense for money that you’ll need in five–to–10 years, an important consideration for retirees who are more sensitive to portfolio volatility as they have less time to recoup losses.

FIXED INCOME RISKS

Interest Rate Risks. Fixed income securities are very sensitive to changes in interest rates. When rates rise, bond prices fall. Conversely, when rates fall, prices rise.

Inflation Risks. Bonds provide a regular income stream, but the purchasing power of this income can deteriorate when inflation rises.

Credit Risk. Credit risk is the extent to which a company might be likely to default, in which case the bondholder could lose some, or all, of their principal.

Liquidity Risks. This is the risk that a bondholder may be unable to sell a fixed income security due to a lack of buyers. In an illiquid market, an investor may be forced to sell at a lower price than they paid for the investment.