Diversification

Diversification is a fundamental risk management strategy designed to reduce exposure to any single asset or market fluctuation by spreading investments across various asset classes, sectors, and geographic regions. The goal is to balance an investor’s risk tolerance with their time horizon, ensuring long-term portfolio stability and growth potential. A well-diversified portfolio includes assets with low correlation, meaning they respond differently to market conditions so that when one investment underperforms, others may offset the loss. While diversification cannot eliminate risk entirely, it remains one of the most effective strategies for minimizing volatility and achieving sustainable, long-term financial success. As the saying goes, “don’t put all your eggs in one basket,” because diversification helps safeguard your wealth against unpredictable market swings.

Experts

Adam Butler

Alan Gula

Anthony Todd

Axel Merk

David Abrams

David Singer

Doug Eberhardt

Elaine Meyers

Glenn August

Greg Lippmann

Izzy Englander

Jerry Wagner

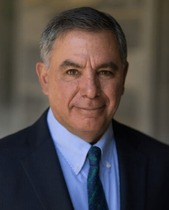

John Olson

Keith Fitz-Gerald

Ken Tropin

Martin Leibowitz

Matt Hougan

Michael Valdes

Nadine Wong

Rebecca Rothstein

Reza Zafari

Rod Westmoreland

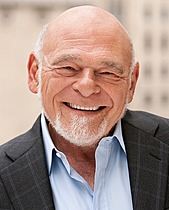

Sam Zell

Stanley Druckenmiller

Tom Lee

Victor Dergunov

ABOUT DIVERSIFICATION

Diversification is a core investment strategy that spreads your money across different asset classes and investment types to reduce overall risk.

Because various assets perform differently under changing market conditions, diversification helps protect your portfolio from sharp declines in any single investment.

A well-diversified portfolio typically includes a mix of stocks, bonds, cash equivalents, and real assets, along with diversification within each asset class.

Investors can also diversify geographically by including foreign assets, or by varying industries, company sizes, and investment durations.

HOW TO BUILD A DIVERSIFIED PORTFOLIO

Diversify Across Asset Classes – Combine equities (stocks), fixed income (bonds), cash and cash equivalents, and real assets such as property to balance risk and return potential.

Diversify Within Asset Classes – Spread investments across different sectors, company sizes, and regions – In fixed income, use bonds from multiple issuers and with varying maturities.

Invest globally – Include international investments to reduce exposure to country-specific risks and capture global growth opportunities.

Review and Rebalance Regularly – Revisit your portfolio periodically to ensure your asset mix aligns with your goals, especially after major market movements or life events.

DIVERSIFICATION MISTAKES TO AVOID

Overdiversification – Investing in too many overlapping funds or securities can dilute returns and increase costs without meaningfully reducing risk.

Ignoring Correlation – True diversification involves holding assets that move differently from one another; otherwise, your portfolio may not be as balanced as it seems.

Neglecting to Rebalance – Market shifts can distort your target allocation over time. Regular rebalancing keeps your portfolio aligned with your risk tolerance and long-term strategy.