Exchange Traded Fund

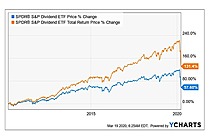

Exchange-Traded Fund (ETF) is a form of securities that trade on an exchange that contains many types of investments, including stocks, commodities, bonds, or a mixture of investment types. Considered as a marketable security, ETFs are easily bought and sold, offering the best attributes with lower fees and tax-efficiency. A one-size-fits-all solution, ETFs combine the features of a mutual fund, with the intraday trading feature of a closed-end fund. ETFs can be more cost-effective and more liquid than mutual funds, enabling them to have more diversification benefits while also mimicking the ease with which stocks are traded.

Experts

Jeremy Deems

Adam Butler

Albert Yeh

Andy Clarke

Aniket Ullal

Ari Pine

Ari Wald

Art Hogan

Arthur Hayes

Bill Lipschutz

Bill Strazzullo

Blair Hull

Bob Froehlich

Bob Iaccino

Brendan Ahern

Brett Harrison

Brian Portnoy

Brian Taylor

Bud King

Charles Biderman

Charles Noble III

Chris Berry

Chris Hausman

Christian Fromhertz

Christine Sandler

Corey Hoffstein

Dan Ahrens

Dan Bortolotti

Daren Riley

Dave Mazza

David Berns

David Kotok

David Stevenson

David Trainer

Doug Eberhardt

Ed Campbell

Edwin Choi

Edwin Elton

Eli Rauch

Eric Weigel

Erik Conley

Euan Sinclair

Francis Gannon

Frank Holmes

Frank Serebrin

Geoffrey Webster

George Douglas

George Milling-Stanley

George Patterson

Greg King

Harry Clark

Imran Lakha

Irina Dorogan

James Davolos

James Seyffart

Jamie Coutts

Jan van Eck

Janet Brown

Jared Dillian

Jason Bodner

Jason Katz

Jason Kelly

Jason Richey

Jay Jacobs

Jay Pelosky

Jeff Kilburg

Jeff Marcus

Jeff Ross

Jeffrey Hirsch

Jeremy Schwartz

Jerry Hwang

Jessica Rabe

Jim Masturzo

Jim O'Shaughnessy

Joe Cavatoni

John Bartlett

John Ciampaglia

John Murphy

John Netto

Jonathan DeYoe

Jonathan Krane

Jono Steinberg

Kathleen Moriarty

Kathy Lien

Katrina Radenberg

Keith Dicker

Kevin O'Leary

Kristen Capuano

Larry Raffone

Lee Robertson

Leland Clemons

Liqian Ren

Lucas Downey

Lyn Alden

Marc Chaikin

Marc Mayer

Marc Pfeffer

Marie Dzanis

Mark Newton

Martin Gruber

Matt Hougan

Matt McCall

Matt Tucker

Matthew Tuttle

Matthew Waz

Micah Wakefield

Michael Corcelli

Michael Gayed

Michael Pento

Michael Steinhardt

Michael Venuto

Mick McLaughlin

Mike Philbrick

Morgan Paxhia

Moss Crosby

Nigam Arora

Noah Hamman

Noreen Beaman

Patrick Ceresna

Patrick Watson

Paul Kim

Paul Krake

Peter Churchouse

Rayne Steinberg

Rick Pendergraft

Roji Abraham

Ron Rowland

Ron Vinder

Royce Running

Russ Koesterich

Russell Wild

Saker Nusseibeh

Sam Bankman-Fried

Scott Dooley

Shundrawn Thomas

Stephanie Pierce

Stephen Burke

Steve Blumenthal

Steve Craig

Steve Ehrlich

Steve Hawkins

Steven Schoenfeld

Tariq Dennison

Thejas Nalval

Tim Maloney

Tim Price

Tom Jacobs

Tommy Thornton

Tony Crescenzi

Tony Sagami

Tony Zhang

Will Hershey

Will Rhind

Xavier Rolet